Monsanto Employees: Understanding your Stock and Options as the Bayer Merger Approaches

As we approach the Monsanto-Bayer merger, it’s important to understand what you have and what you can expect to happen with your Company Stock, Options and Restricted Stock. Without a finance degree, it can be difficult to decipher your holdings. You might be embarrassed to admit you don’t understand what you have. Trust me, you aren’t the only one. Let’s unpack what you have and things you should think about as the merger approaches.

Understanding What You Have:

Monsanto compensates employees in different forms of company stock to make sure that employees are engaged in helping the company succeed, which would in turn grow the value of the company. Here are the forms of stock compensation.

Options:

When you are granted options, the company is giving you a window to purchase its stock at the grant date price. As long as the stock goes up from grant date, they have value. Options only have value when the stock price increases from the value at the grant date. Therefore the value of options can vary widely ($0-$?) depending on the performance of the company.

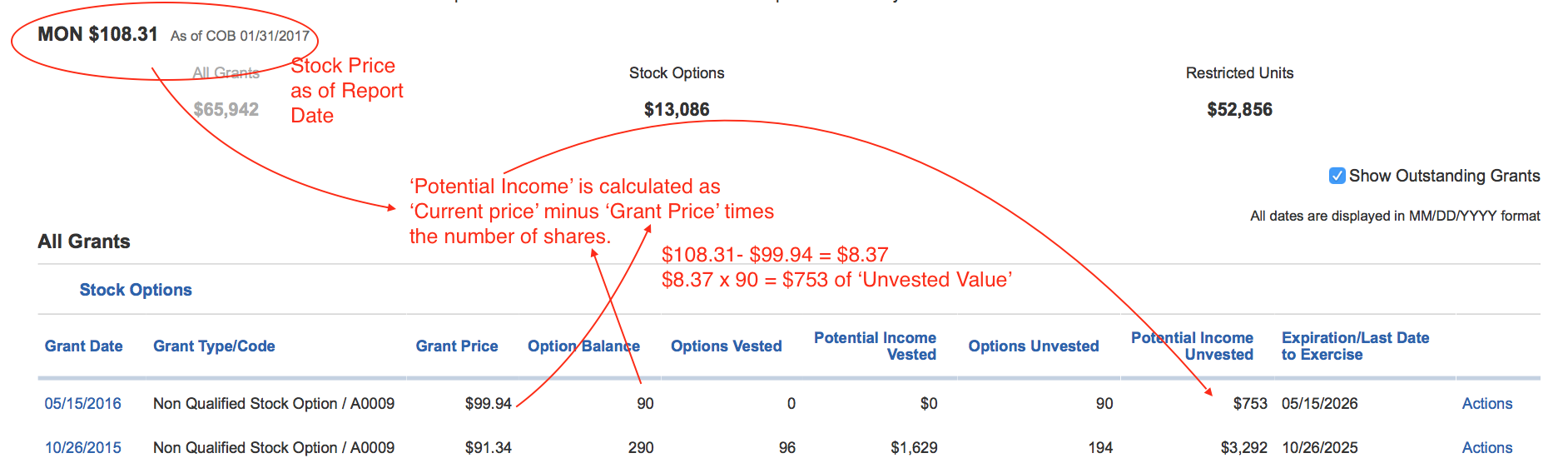

In the example from a statement below, an employee was granted 90 options on 5/15/16 at a grant price of $99.94. Based on the price of $108.31 as of 1/31/17, they had ‘unvested potential income’ of $753. Based on today’s price (4/20/17, 11:37AM) of $115.97, the value would now be $1,442.70

Because the shares are ‘unvested’ you can’t really do anything with the value yet, but it’s there on paper. Under the current structure, ⅓ of your options will ‘vest’ each anniversary date of grant in the 3 years following the grant. So in this case, the employee’s options would all be vested (ignoring the merger) on 5/15/2019. Also notice, that the options ‘expire’ on 5/15/26. If you take no action prior to expiration date on options, they are worthless. If the price of a company were to fall and never go above the grant date value, you’d would let an option expire and you’d get nothing for it.

Restricted Stock Units:

Restricted stock units (RSUs) are much more straightforward. When you are granted RSUs, the company is giving you shares of its stock as a form of compensation, but the catch is that you don’t officially get the shares until after they ‘vest’. In your case at Monsanto, RSUs vest over 3 years. This is a tool to help the company retain its employees. Once the Restricted Stock ‘vests’ it turns into plain ‘ol company stock that you can do with what you’d like.

Company Stock:

If you’ve been with the company for a while, it’s likely that you hold some company stock outright that was previously Restricted Stock. Ignoring the merger, this is yours to do with as you please. You are free to hold it indefinitely or sell at any point. The value of this asset is simple: it’s the current price of the stock times the number of shares you own.

What Will Happen at the Merger:

At the merger, Bayer has agreed to pay $128/share. As of this post, the current price is $115.97 (4/20/17, 11:37AM), representing a $12.03 premium to current value.

The Good - Immediate Vesting!

Under the terms of the sale, all of your options and restricted stock will immediately vest at close! You will receive a payout of cash (less tax withholding) for the value of all of your restricted stock and options.

The Bad - Time to Pay the Tax Man

Options--Under normal circumstances, you are taxed on options only when you exercise them. At that point, you pay ordinary income tax (just as if it were a paycheck) on the difference between current value and grant value. So if for example, you exercised 5 options that were granted at a price of $100 at a current price of $110, you’d pay tax on $50 of gain ($10 per share x 50 shares). Under the terms of this merger, your options will be exercised at a price of $128, resulting in additional income and taxes due on that income in the year the merger is finalized.

RSUs--Under normal circumstance, you are taxed on RSUs as ordinary income when they vest. Typically the company will withhold some portion of the stock as tax and you’ll then have a reduced balance of shares to be held as common stock. Under the terms of this merger, your RSUs will immediately be sold at a price of $128, resulting in additional income and taxes due on that income in the year the merger is finalized.

Company Stock--Because your shares will be sold, you will pay tax on the gain at time of merger. However, you’ll only pay capital gains rates here, which for most is only 15% vs. your ordinary income tax rate that could be as high as 39.6%.

Planning Ahead for the Proceeds

If you’ve done the math on what you can expect in terms of cash payout, you realize it may be a large amount. This is great, but you also don’t want to squander the opportunity. Start thinking now about what you’ll use those proceeds for --- maybe padding an emergency fund, paying down debt, setting aside money for college or taking a trip that you’ve put off. If you spent time thinking about this before the day comes, you’ll be much better equipped to use the proceeds wisely.

Because we work with Monsanto clients, we’ve helped many simplify the process of understanding what they’ll have at close with a custom template. If you’d like a copy of that spreadsheet to help you quickly analyze your RSUs/options, we’d be happy to share it.

If you would like help understanding and planning for your Monsanto Stock, we can help. Email andrew@modern-dollar.com.

Note: This content is property of Modern Dollar Planning, LLC. If you are a financial advisor reading and would like to use this content, you must receive our express written consent.