Don’t Leave Money on The Table During Open Enrollment

It’s easy to get complacent and just roll forward your selections from previous years or haphazardly whip through your choices at benefits time, but we encourage you to think through them (or have an advisor help you!).

Spending an hour digging deeper into your choices could save you thousands. Do you earn $1,000/hour in your work? Probably not! Invest some time into thoughtfully making your benefits elections this year.

Health Insurance

For most, the biggest decision is health insurance. In helping our clients select health insurance, we’ve seen most tend to gravitate toward the traditional PPO type plans before we help them examine further. If you haven’t done any math, this might seem like the ‘safe’ play.

We strongly encourage you to consider a high deductible health plan, assuming your company offers it. Many times, the premiums on these plans can be thousands less than the PPO option. In exchange, the deductibles on these plans might be higher, but keep in mind that many preventative services are covered and are not subject to that deductible.

We work with many Bayer executives, so let’s look at an example from their 2020 health insurance options. You may not work for Bayer, but the same thought process could be applied in selecting from your company’s offerings.

For this example, we’re going to compare the costs for a ‘Family’ election where the Bayer employee is covering themselves, spouse and at least one child. We also assume that this family is using ‘In-Network’ care.

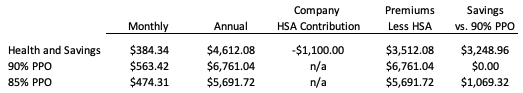

Here are the premiums in Bayer’s ‘Family’ Offering for 2020:

The ‘Health and Savings’ plan is Bayer’s high deductible option. As you can see it offers a savings in premiums of over $3,400/year vs. the 90% PPO option. If you know your way around health insurance, however, you know there is a tradeoff for that savings.

Let’s look at the respective deductibles and out of pocket maximums for each of these plans. Remember, ‘deductible’ means the amount you will pay if you actually need to use medical services before your insurance company starts paying a percentage of the cost. (Important note: Preventative care is 100% covered even if you haven’t met the deductible.) ‘Out of Pocket Maximum’ is the most you’d pay if you racked up big medical expenses before the insurance company pays the rest.

Now you might be saying, “See, I told you those high deductible plans are dangerous! Look how much I’m on the hook for if we have big medical bills next year!”

Let’s take a closer look, though, at the ‘best’ and ‘worst’ case scenario under in plan. The ‘best’ case means you only had to pay your premiums because you used no medical services throughout the year. The ‘worst’ case means you paid your premiums and also had such high medical expenses that you actually hit the max out of pocket costs for services.

As you can see, the High Deductible plan actually comes out on top in ‘best case’ and ‘worst case’ scenarios. In our eyes, if you’re on a family plan at Bayer, this should be a no brainer! Choose the high deductible plan.

The other benefit we haven’t even discussed yet is the fact that choosing this plan also allows you to contribute to a Health Savings Account (HSA), a tool we absolutely love. An HSA allows you to set aside money before tax for future health expenses. For a family, the 2020 maximum contribution is $7,100 (plus $1,000 for those over age 55). In this example, the company is contributing $1,100 into the HSA on your behalf. Keep in mind that HSA dollars are yours to keep - they can be carried forward from year to year.

When you eventually use the money in an HSA for a health-related expense, it comes out tax free! In addition, this money can be built up over the years and the dollars can be invested, just as you do in your 401k or 403b. If you’re a high earner and already maxing out your 401k/403b, it can be a great tool to build up another tax sheltered bucket for eventual health expenses. If you hope to retire early and expect to pay for your own health insurance before Medicare kicks in at age 65, you could use this account to cover the premiums. We believe that eventually during your life you’ll have some sort of healthcare cost that the HSA could be used to cover.

Run some numbers to make sure you aren’t leaving money on the table and don’t be afraid to consider the high deductible plan. Yes, you might have to pay a bill for a sick visit to see your doctor, but in most cases, you’re paying thousands less in a premiums throughout the year.

Other Benefits:

Choosing a health plan might be the weightiest decision during open enrollment, but here are a few additional tips for the choices that often go overlooked.

Disability Insurance:

Hopefully your company offers group disability insurance. It’s not fun to consider and we hope that you never need it, but the reality is there is a real chance that you could at some point. The Social Security Administration estimates that for those born in 1991, there is about a 1 in 4 chance that you’ll need disability coverage before your retirement age.

If you’re earlier in your career or a high earner, disability insurance is extremely important because your ability to work and earn is your most valuable asset.

If your company offers this at no cost to you, great! If however, they offer a baseline coverage with the ability to ‘supplement’ that coverage, give it some thought.

We like to see clients carry at least 60% coverage. This means that should they became disabled, they would receive a monthly benefit of 60% of their income. Consider ‘buying up’ the group coverage if you’ve got less than 60% or look elsewhere for an individual policy.

There are many nuances to disability coverage, so read the fine print or engage an expert to help select the right amount and type of coverage.

Group Life Insurance

Most companies offer a baseline level of life insurance coverage. Often times it will be equivalent to 1 or 2X your base salary.

If you’ve got young kids or other family depending on your income, it’s likely this isn’t enough. You may be able to supplement this with an additional multiple of your salary through your company. Again, if you aren’t comfortable calculating your total life insurance need, engage an expert.

Keep in mind, purchasing extra life insurance through your workplace plan means that if you leave your position, you aren’t guaranteed to get the same deal at your next job. Also, the costs typically increase each year as your age is big determinant in the cost. If you have a high life insurance need, you should likely consider buying a term life policy outside of your company’s offerings to ensure that you have it even if you change jobs. An individual term life policy also keeps your costs from increasing each year because most offer level premiums while in force.

Dependent Care Flex Spending Accounts (DCFSA)

If you have young kids in a daycare or pre-kindergarten, this one is a must!

A dependent care flex spending account allows you to put aside up to $5,000 pretax for qualified childcare expenses while you and your spouse work.

The money is withheld from your paycheck and deposited to your DCFSA. It can then be used to pay the childcare provider or to reimburse yourself for costs paid out of pocket.

By using the DCFSA, you lower your taxable income by the amount contributed. When you consider that your federal and state income tax rates might be a combined 30%-40%, using this benefit could save you up to $2,000 in taxes!

Keep in mind that the DCFSA is a ‘use it or lose it’ type plan. If you don’t use the dollars in the account, they are forfeited each year (2019 deadline to submit is April 30, 2020).

Last Words

November is the biggest month for benefits elections. While it’s easy to simply gloss over the choices your company offers, we encourage you take a deeper look. You might just find some savings in insurance premiums, be able to lower your tax bill or better protect yourself or your family.